Is Australian Private Debt the Best Bet in a High Rates Regime?

20 May 2024

Only days before the world’s biggest economy was due to default on its debts, the House of Representatives approved a deal to raise its self-imposed US$31.4 trillion debt ceiling.

The deal suspends the debt ceiling until January 2025, saving $1.5 trillion over a ten-year period, according to the nonpartisan Congressional Budget Office.

Markets responded positively, with both Wall Street and the ASX surging after the news was announced. However, indices never fell in the lead-up to the vote, suggesting that investors believed Congress would eventually reach an agreement.

On the 3rd of June, President Joe Biden signed the deal into legislation. It appears that, finally, the U.S. economy can regain the stability it needs to resume its growth trajectory. But will it really?

To understand the bigger picture, let’s take a look at the impact of the debt ceiling on the economy and what opportunities this leaves for investors.

Despite the lengthy debate, the deal won’t make a dent in the debt.

The agreement imposes limits on "non-defense discretionary spending" only. This category, which includes education, national parks, and scientific research accounts for less than 15% of the $6.3 trillion spent by the U.S. in the last fiscal year, approximately $945 billion.

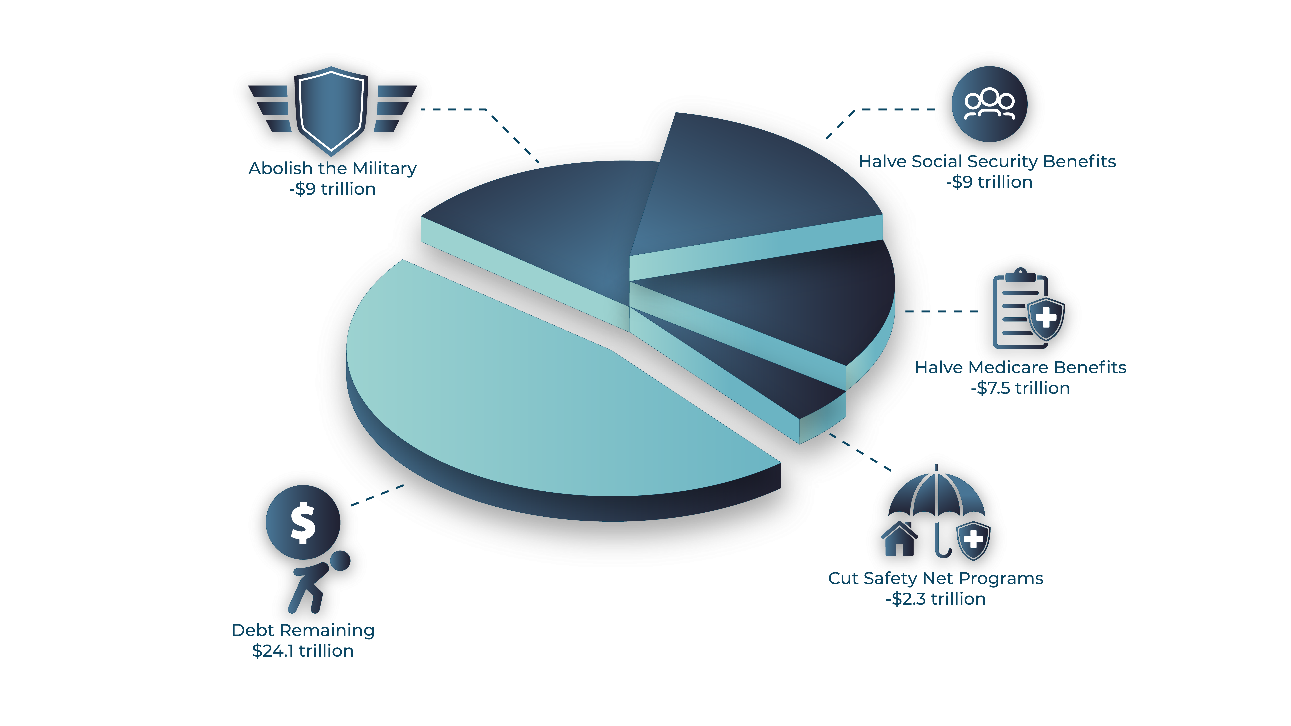

These savings are not expected to have a substantial impact on the country's major expenditures, which include Social Security, Medicare, and military spending, comprising 77% of the previous year's budget or $4.9 trillion.

But the deal won't just fail to save the U.S. budget – it's also going to bring about changes that investors need to keep an eye on

In the wake of the deal, the U.S. Treasury may issue more Treasury bills to boost cash reserves, which could result in less money available in the market. Although the Federal Reserve might introduce some course-corrections to mitigate the most serious impacts, this move could still affect the cost and availability of money.

The large number of Treasury bills expected to enter the market could potentially divert funds originally intended for stocks, which will have a ripple effect on equity markets.

Investors might not see a significant boost in share markets after the bill is approved. Many are concerned that the reductions in government spending could slow down economic growth.

Reduced federal spending until 2025 will have a flow-on effect on businesses and hinder their hiring ambitions. According to Mark Zandi, chief economist at Moody’s Analytics, 150,000 jobs could be lost by the end of next year, which will push up the unemployment rate, currently at historic lows.

The resumption of student loan repayments, and the changes in the government's assistance programs, which are part of the deal, may reduce even further households’ disposable income.

In addition, moving from abundant liquidity (as it’s been for the last five months) to a system with limited and expensive cash, could send the already fragile economy into recession.

Reserve might introduce some course-corrections to mitigate the most serious impacts, this move could still affect the cost and availability of money.

The large number of Treasury bills expected to enter the market could potentially divert funds originally intended for stocks, which will have a ripple effect on equity markets.

In the wake of the 2011 debt ceiling crisis, Standard & Poor's stripped the United States of its AAA rating, citing heightened political polarisation and insufficient fiscal measures. As a result, Treasury's borrowing costs rose about $1.3 billion, that year.

At the time, the other two major rating agencies, Fitch and Moody’s confirmed their AAA ratings. But after the recent deal, Fitch and other smaller agencies have placed their U.S. credit ratings under review.

According to a May report by Moody's Analytics, downgrading Treasury debt would trigger credit implications and downgrades across many different institutions — in addition to a further increase in borrowing costs for the federal government.

In the long term, if U.S. debt is viewed as risky, borrowing costs could increase for the government. Combined with the significant withdrawal of cash from the market, this could raise interest rates, making borrowing money more expensive for everyone.

While the world was captivated by the weeks-long debt ceiling debate, on the other side of the planet an often overlooked economy was quietly delivering a surplus.

Australia was close to delivering a surplus with the May 2020 budget, but the pandemic derailed the liberal government’s plans. With increasing global uncertainty, high interest rates and inflation, no one was expecting Australia’s Treasurer Jim Chalmers to bring the country back in the black. But he did.

Although small, the $4.2 billion surplus is the first surplus in 15 years, and a remarkable improvement from the $36.9 billion deficit predicted in October.

But there are other structural reasons that explain Australia’s strength and resilience in the face of global uncertainty. These factors also make it a great investment destination, despite being a 20-hour flight from the strongest economy in the world.

Australia has demonstrated remarkable resilience to global economic crises, one of the few developed economies to avoid a recession during the 2008 Global Financial Crisis. This stability is underpinned by a robust banking system, sound fiscal policies, and a comprehensive regulatory framework, giving investors confidence in the country’s economic strength.

As a mature democracy, Australia offers a stable political environment with a strong rule of law and governance standards. It also boasts a well-developed regulatory environment, with bodies like the Australian Securities and Investments Commission (ASIC) and the Australian Prudential Regulation Authority (APRA) which ensure businesses operate with integrity and transparency.

Australia consistently ranks among the easiest places to conduct business due to streamlined regulations, advanced infrastructure, and a highly skilled workforce. The nation's strategic position in the rapidly growing Asia-Pacific region enhances its appeal. Furthermore, Australia maintains a liberal approach to foreign investment, with policies designed to attract capital to high-growth sectors.

Australia stands as a leading player in technology and innovation, excelling in sectors like fintech, medtech, agtech,

and renewable energy. In addition to technological prowess, the country is rich in natural resources, including coal, iron ore, gold, and natural gas, which create significant investment opportunities.

Australia's solid trade relationships with major economies like China, the U.S., and Japan offer significant advantages. The country also benefits from numerous free trade agreements, facilitating ease of international business and adding to its attractiveness as an investment destination.

Australia holds a "AAA" credit rating from all three major credit rating agencies, an honour shared by only nine countries globally. This achievement is especially significant considering that, as mentioned above, the U.S., holds the highest rating across only two of the three major rating agencies.

Additionally, Australia’s significantly lower debt to GDP ratio and firm rule of law ensure robust investor protection, surpassing even that of the United States.

With its diverse and high-performing economy, Australia claims one of the highest growth rates among developed countries over the past 20 years.

Unlike countries such as China, grappling with the 4-2-1 problem, and Japan, which has been confronting an ageing population for decades, Australia's population growth remains steady. Averaging an increase of approximately 1.3% per year over the past three decades, this demographic trend has been a key pillar supporting the country's strong GDP growth.

Furthermore, Australia boasts a balanced portfolio of key sectors, a cornerstone of its economic resilience and consistent growth. In the 2023-24 period, the Australian economy is projected to expand by 1.5%, supported by a decrease in interest rates to 3.25% and a wage increase of 0.75%.

While the potential risks associated with the U.S. debt ceiling may not entirely materialise, it is clear that the situation presents a complex and uncertain economic landscape for investors.

In contrast, stability, prudent economic management and growth outlooks make Australia an attractive and less risky alternative for investors.

FC Capital’s experience in providing tailored capital solutions, enables investors to capitalise on the strength and stability of the Australian market. We help clients explore diverse investment avenues, including acquisition financing, mezzanine debt, and senior debt which contribute to a balanced and profitable investment portfolio.